To prepare an income statement, small businesses must analyze and report their revenues, operating expenses, and the resulting gross profit or losses for a specific reporting period. The income statement, also called a profit and loss statement, is one of the major financial statements issued by businesses, along with the balance sheet https://www.business-accounting.net/ and cash flow statement. Income statements depict a company’s financial performance over a reporting period. Companies produce three major financial statements that reflect their business activities and profitability for each accounting period. These statements are the balance sheet, income statement, and statement of cash flows.

What is an IOLTA Account & 5 Mistakes to Avoid

A business’s cost to continue operating and turning a profit is known as an expense. Some of these expenses may be written off on a tax return if they meet Internal Revenue Service (IRS) guidelines. This data included parent interviews and parent-reported questionnaires to determine their household income and family circumstances. Dartmouth will pair the restoration of required testing with a reimagined way of reporting testing outcomes, ideally in ways that are more understandable for students, families, and college counselors. More significantly, this figure was a full 100 percent for the 79 students who attend a high school that matriculates 50 percent or fewer of its graduates to a four-year college.

Calculate Cost of Goods Sold (COGS)

As you can see, this example income statement is a single-step statement because it only lists expenses in one main category. Although this statement might not be extremely useful for investors looking for detailed information, it does accurately calculate the net income are you making these 7 common sole proprietor tax mistakes for the year. An income statement is one of the most important financial statements for a company. Operating expenses totaling $37,000 were then deducted from the gross profit to arrive at the second level of profitability – operating profit which amounted to $6,000.

Pick a Reporting Period

This type of analysis can be useful when comparing with other companies in the industry. All public companies are required to file a Form 10-K each year with the Securities and Exchange Commission (SEC) and Form 10-Q each quarter which include the income statement and other financial documents and disclosures. By reviewing a company’s income statement, you can quickly pinpoint areas that have room for improvement. https://www.business-accounting.net/mark-to-market-accounting-mark-to-market/ For example, a company could cut costs in one area and put more money into others, such as sales and marketing, that could potentially fuel expansion. “The income statement should be used by anyone trying to understand the business conducted as well as the profitability of a company,” says Badolato. Your net profit margin tells you what portion of each revenue dollar you can take home as net income.

Hey, Did We Answer Your Financial Question?

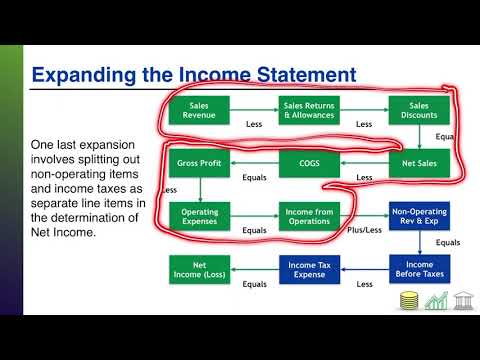

Multi-step income statement – the multi-step statement separates expense accounts into more relevant and usable accounts based on their function. Cost of goods sold, operating and non-operating expenses are separated out and used to calculate gross profit, operating income, and net income. It received $25,800 from the sale of sports goods and $5,000 from training services. It spent various amounts listed for the given activities that total of $10,650. It realized net gains of $2,000 from the sale of an old van, and it incurred losses worth $800 for settling a dispute raised by a consumer. The above example is the simplest form of income statement that any standard business can generate.

You will not see a line item for depreciation on a cash flow statement; it is not a cash transaction. Instead, the full brunt of capital expenditures is recognized when the expenditure actually occurs. The cash flow statement also separates investments and financing transactions. These differences are designed to clarify the actual amount of cash available to the company.

Subtract the cost of interest payments and income tax from your operating income, and you get the bottom line. This is how much money your company brought in for the period of time your income report covers. You, or the managers at your company, are in charge of dealing with total revenue, COGS, and general expenses. Your accountant is responsible for managing your tax burden and your company debt. Multi-step income statements are one of three types of income statement. By reading and analyzing all three financial statements, you’ll get a full picture of your company’s financial performance—so you can plan for growth, and avoid financial pitfalls.

This method, as it affects the income statement, recognizes revenues when the sale of a product or service occurs and expenses when they are incurred. In the below example, the format selected by McDonald’s Corporation illustrates a single-step income statement with separately reported income taxes. An income statement represents a period of time (as does the cash flow statement). This contrasts with the balance sheet, which represents a single moment in time. Your income statements are most powerful when used in tandem with your balance sheet and cash flow statements.

- All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program.

- Finally, we arrive at the net income (or net loss), which is then divided by the weighted average shares outstanding to determine the Earnings Per Share (EPS).

- The two sub-elements within the operating category are revenues and expenses.

- For example, a company could cut costs in one area and put more money into others, such as sales and marketing, that could potentially fuel expansion.

- Some of those line items can be grouped together into categories, while others stand alone as categories of their own.

It is common for companies to split out interest expense and interest income as a separate line item in the income statement. An income statement should be used in conjunction with the other two financial statements. It provides insights into a company’s overall profitability and helps investors evaluate a company’s financial performance. Directors and executives are also provided a clear picture of the performance of the company as a whole during a specific accounting period.

Our easy online application is free, and no special documentation is required. All applicants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. The applications vary slightly from program to program, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. This net income calculation can be transferred to Paul’s statement of owner’s equity for preparation.

It is simply one data point among many, but a helpful one when it is present. Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

These include the net income realized from one-time nonbusiness activities, such as a company selling its old transportation van, unused land, or a subsidiary company. Investors and creditors analyze the balance sheet to determine how well management is putting a company’s resources to work. Total assets should equal the sum of total liabilities and shareholders’ equity. Shareholders’ equity is the difference between assets and liabilities, or the money left over for shareholders for the company to repay all its debts.

Thus, the Cash Flow statement is particularly useful in determining taxable income. Like the name mentions, the figures on the balance sheet must match as any increases or decreases must be offset. Unlike the income statement, it does not provide information on how much money the company has made or lost, it only provides the amount of debt, cash and other assets that the company owns at that point in time. Because of its importance, earnings per share (EPS) are required to be disclosed on the face of the income statement. A company which reports any of the irregular items must also report EPS for these items either in the statement or in the notes. They are reported separately because this way users can better predict future cash flows – irregular items most likely will not recur.

Finally, we arrive at the net income (or net loss), which is then divided by the weighted average shares outstanding to determine the Earnings Per Share (EPS). Learn to analyze an income statement in CFI’s Financial Analysis Fundamentals Course. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website.

Gains represent all other sources of income apart from the company’s main business activities. EBIT is the resulting figure after all non-operating items, excluding interest and taxes, are factored into operating profit. Operating expenses are basically the selling, general, and administrative costs, depreciation, and amortization of assets.